Favorite (5)

Favorite (5)

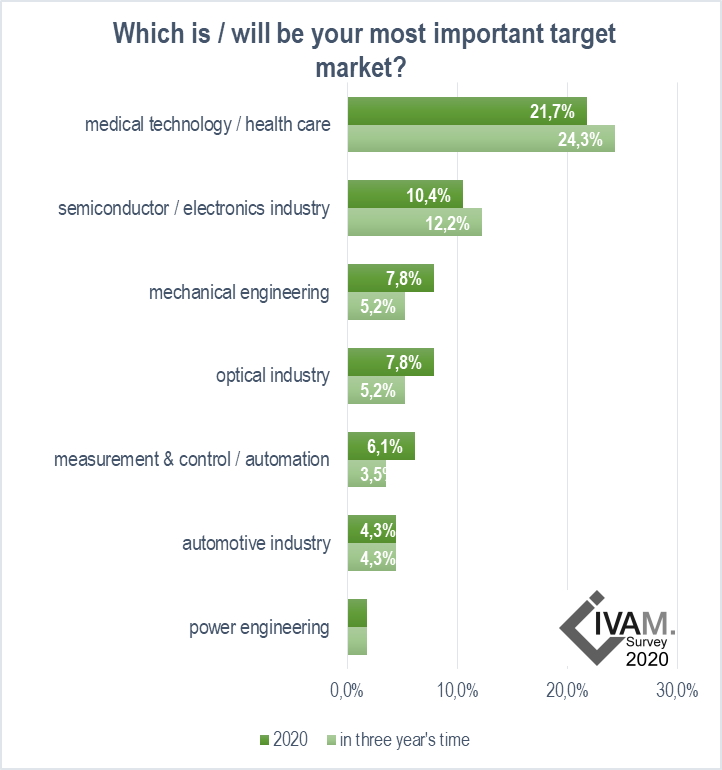

In 2020, medical technology is the most important market for 21.7% of all respondents. The upward trend will continue and medical technology is supposed to be the most important market in three years for 24.3% of organizations.

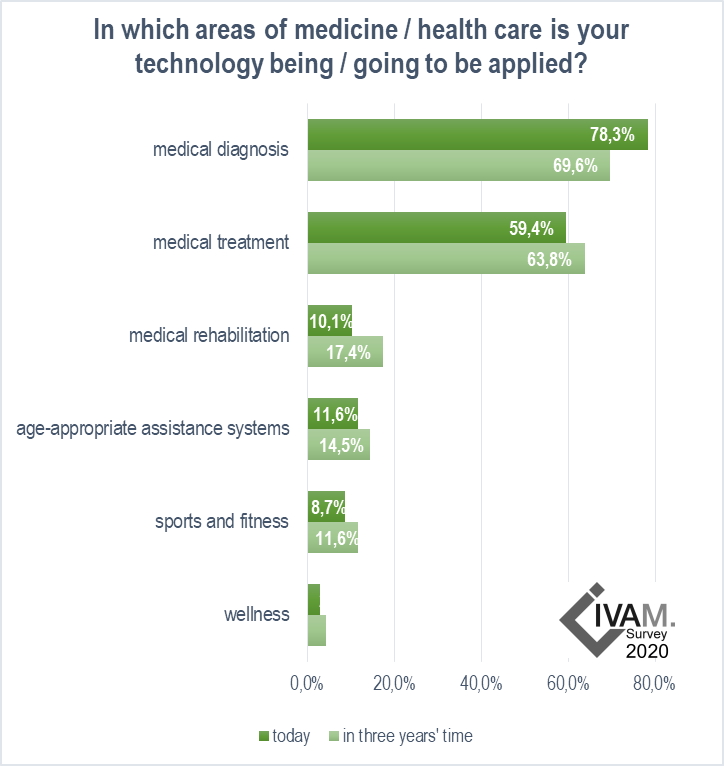

Medical microsystems are mainly used in diagnostics (78.3% of organizations targeting the medical technology market) and treatment (59.4%) – this has hardly changed compared to 2017 and will not change much in the next three years: the share in diagnostics is expected to decrease, while the share in treatment will increase.

Today, 48.7% of the microtechnology companies and institutes active in the automotive industry are involved in drive engineering (in 2017 it was 42.7%) – a decline to 41.0% is expected in the next three years.

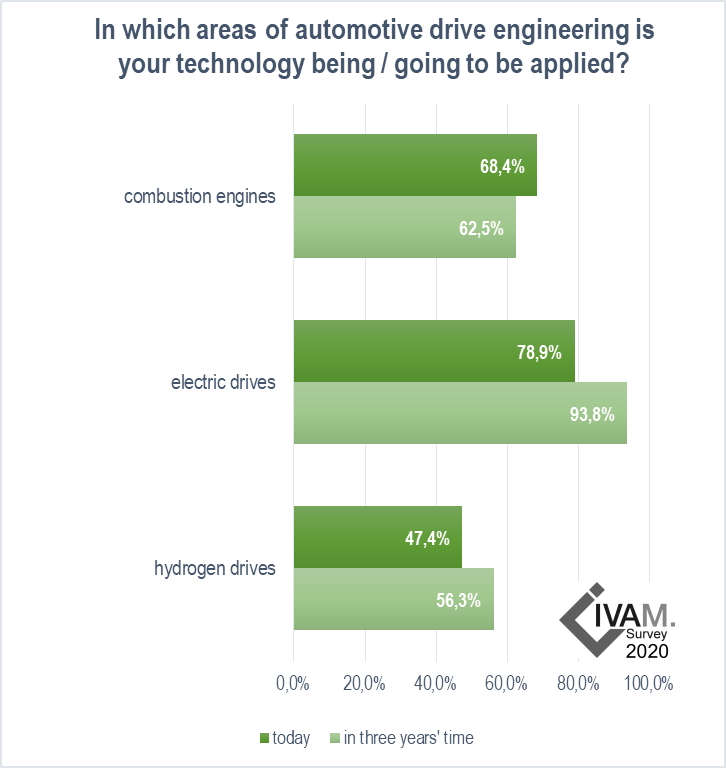

A little more than two-thirds (68.4%) of the companies and institutes involved in automotive drive technology work on the combustion engine, and the proportion is expected to decline somewhat in the medium term to 62.5%.

However, a higher proportion (78.9%) are already working on the electric drive; this proportion is expected to rise to over 90% within in the next three years.

Almost half (47.4%) of the companies and institutes involved in drive engineering are working on hydrogen drives, and the proportion is expected to rise to over half (56.3%) within the next three years.

In total, 32.2% of the companies and institutes are active in measurement & control technology / automation – 37.3% are active in mechanical engineering.

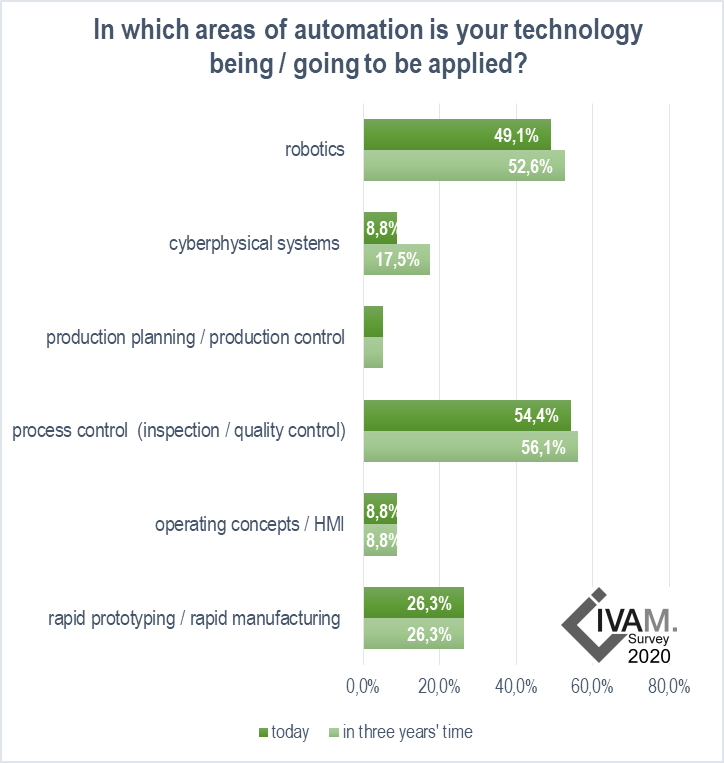

Process control in the microtechnology industry is the most common application field in automation / mechanical engineering today: 54.4% of organizations supply this field. This share will increase slightly to 56.1% in the medium term.

Robotics follows in second place with 49.1% – in three years’ time it might be slightly more (52.6%).

26.3% of organizations are currently active in the field of rapid manufacturing/rapid prototyping, and this proportion will remain stable in the medium term.

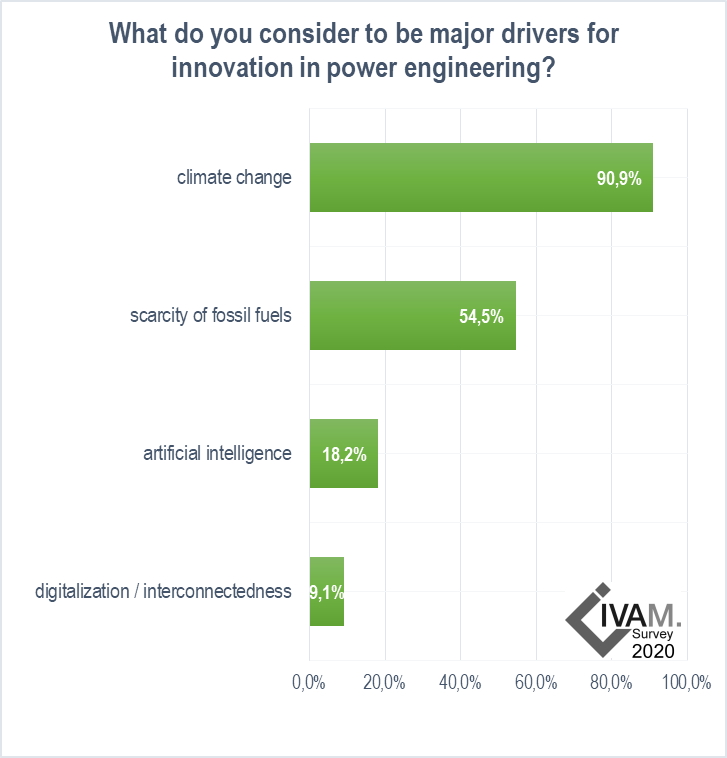

Not surprisingly, climate change is considered to be the strongest driver for innovation in power engineering – 90.9% of the companies and institutes targeting this industry think so.

The scarcity of fossil fuels is considered to be an important driver of innovation by more than half (54.5%) of the companies and institutes active in power engineering.

Energy storage is an attractive topic for the industry: 63.6% of organizations working on power engineering supply products and technologies for this area; this proportion will rise within the next three years.

The share of companies and institutes working on alternative drives will also rise from 45.5% today to 63.3% in three years’ time.

Overall, a rather small proportion (9.3 %) of the responding companies and institutes are active in power engineering to date.

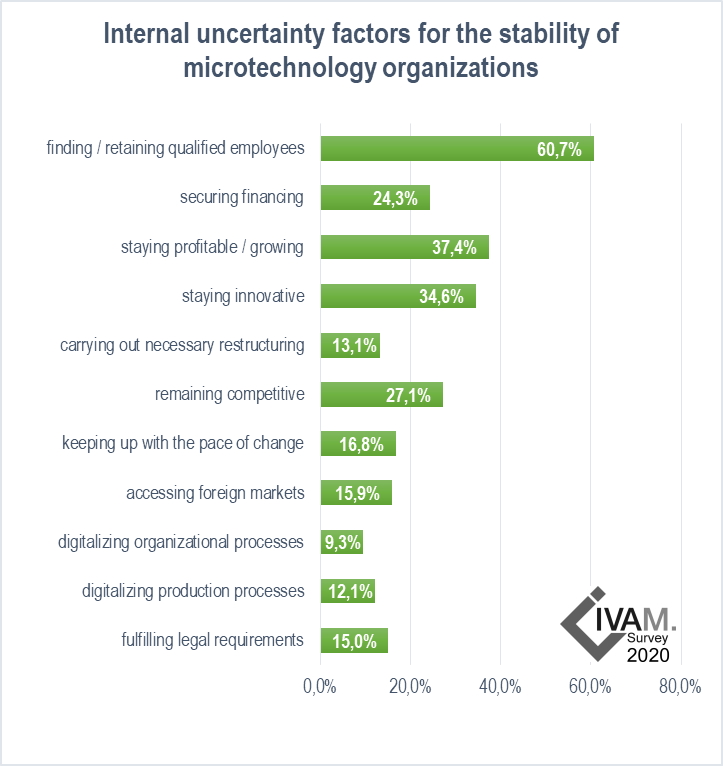

Competition for specialists is becoming apparent in the microtechnology industry: 60.7% of organizations see finding and retaining qualified employees as an uncertainty factor for the stability of their organization. Enterprises and research institutes alike are bothered by the need to find and retain qualified employees.

Sustained profitability (37.4%) and innovative strength (34.6%) are factors of uncertainty for more than a third of microtechnology organizations. 27.1% of those surveyed are concerned about their competitiveness.

Evidently, remaining competitive and innovative, the opening up of foreign markets and, above all, staying profitable are factors of uncertainty that weigh more heavily on enterprises than research and university institutes. The proportion of enterprises that are concerned about being able to operate profitably or grow is remarkably high at 45.3%.

The proportion of companies and institutes for which legal requirements represent an uncertainty factor is rather low at 15%.

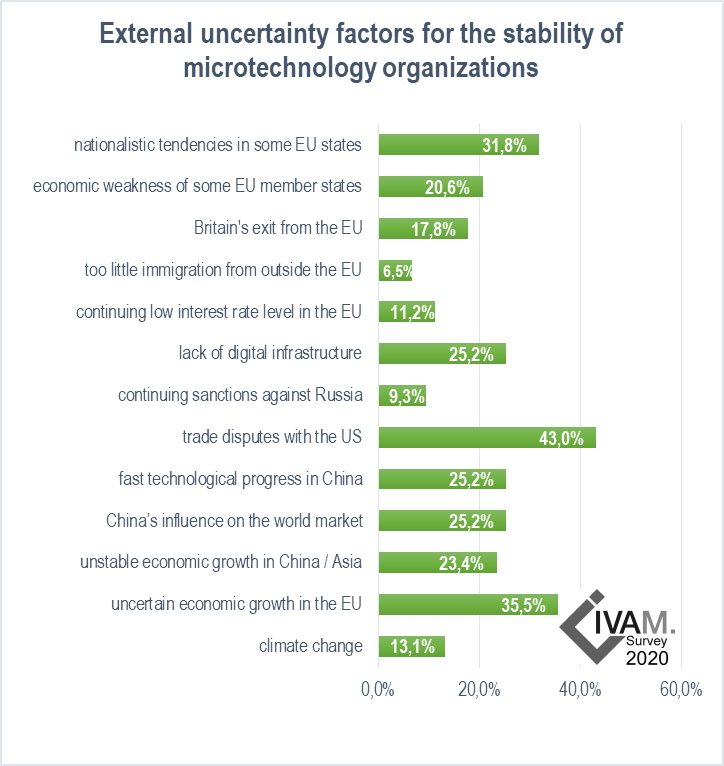

At the time of survey (mid-February to mid-March 2020) the trade dispute with the USA was the biggest external uncertainty factor for the European microtechnology industry (43%).

Uncertain economic growth in the EU (35.5%) and nationalist tendencies in the EU (31.8%) also cause concern in the microtechnology industry.

Evidently, trade disputes and economic uncertainties are greater factors of uncertainty for companies than for research institutes.

The fast technological progress in China and climate change are, however, noticeably greater factors of uncertainty for research institutes than for companies.

Brexit is particularly problematic for companies in Great Britain (60%), but in total only for 17.8% of the companies and institutes surveyed.

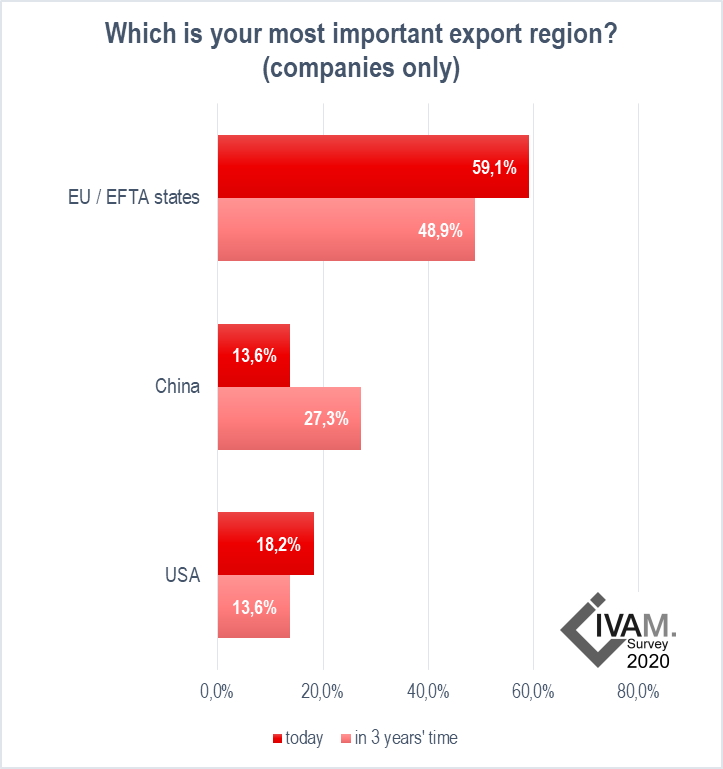

For the European microtechnology industry foreign trade in early 2020, as in previous years, concentrates on the EU and EFTA states: for 59.1% of companies, this is the most important export region.

Companies expect exports to the USA to decline – probably due to the current trade conflicts (see external uncertainties). At present, the USA is the most important market for 18.2% of companies; the USA is still ahead of China with 13.6%.

But in three years' time only 13.6% of companies see their primary export market in the USA, compared to 27.3% in China.

Whether the forecasts for the medium-term development of the international markets will actually come true is uncertain due to the current economic uncertainties caused by the Corona crisis.

Economic state and development of the microtechnology industry was good last year, but the corona crisis is likely to have halted the positive trend and, above all, made forecasts for medium-term development invalid.

IVAM conducted the survey in February and early March 2020 before parts of the economy were shut down and the full impact of the coronavirus pandemic became apparent.

In a quick survey among members of the IVAM Microtechnology Network conducted at the end of March, the participants were still confident and did not fear any serious long-term economic consequences. The result of this survey have been published here: https://www.ivam.de/corona_krise

For more than ten years, the IVAM Microtechnology Network has been asking the microtechnology industry in Europe at the beginning of each year about its economic situation, strategies and trends. In February/March 2020, more almost 3,000 companies and research institutes in Europe have been asked about their economic situation and expectations, their international activities, market and application trends, drivers for innovation, and uncertainty factors for the stability of their organization.