Favorite (5)

Favorite (5)

Medical approvals such as emergency use authorization (EUA) by the US Food and Drug Administration (FDA) and CE marking were simplified. Even during this chaotic period with lockdowns and supply issues, microfluidics players showed maturity in solving problems in their domains. Challenges are now to keep this dynamic by diversifying the portfolio of tests for POC solutions and extending the use of next-generation sequencing for predictive health care.

Several new players reached the commercialization stage of their products. lumiraDx and Cue Health are two good examples related to the pandemic crisis. After more than five years of prototyping, they have developed the right solutions at the right moment. lumiraDx has developed a non-expensive POC solution based on a polymer microfluidic module allowing an immunoassay test. And Cue Health has also developed its business on POC solutions based on polymer microfluidic modules allowing a polymerase chain reaction PCR in a few minutes. Both companies have since shown incredible revenue growth in only two years. lumiraDx had a 75% growth YoY2020-2021 in revenue and 3900% for Cue health. The post-COVID-19 challenges are coming for these players. Young companies have little underlying resources in comparison to big diagnostics companies. They now must find a way to stabilize their business.

Larger players also experienced huge growth these last years. Illumina, the top player in the microfluidics market over the past several years, saw an increase of 40% in revenue. In contrast, BGI, positioned in the same market, faced a decrease of 20% in revenue due to a conflict of interest with Illumina. Cepheid, one of the top 2 and a part of the Danaher group, got an impressive 200% YoY2020-2021 in revenue, mainly driven by the sales of their instruments and microfluidic modules. BioMérieux, Abbott, Thermo Fisher Scientific, Roche Diagnostics, and Becton Dickinson had broadly the same growth (30-50%) in terms of microfluidic revenue at the module level, all from developing their own modules to be used in instruments already in the market (e.g., Becton Dickinson, BD MAX). Larger companies acquired small to mid-size microfluidics companies to quickly integrate new products and competencies related to rapid diagnostics based on PCR or immunoassay tests. Thermo Fisher Scientific acquired Mesabiotech, Roche acquired GenmarkDx, and Diasorin Molecular acquired Luminex.

After many new investments to scale up their production facilities and install a huge number of instruments, microfluidics players will have to find the right solutions to make their investments profitable. This could be done by diversifying their portfolios and activities, laying off employees, or bigger players could find smaller companies interested in being acquired.

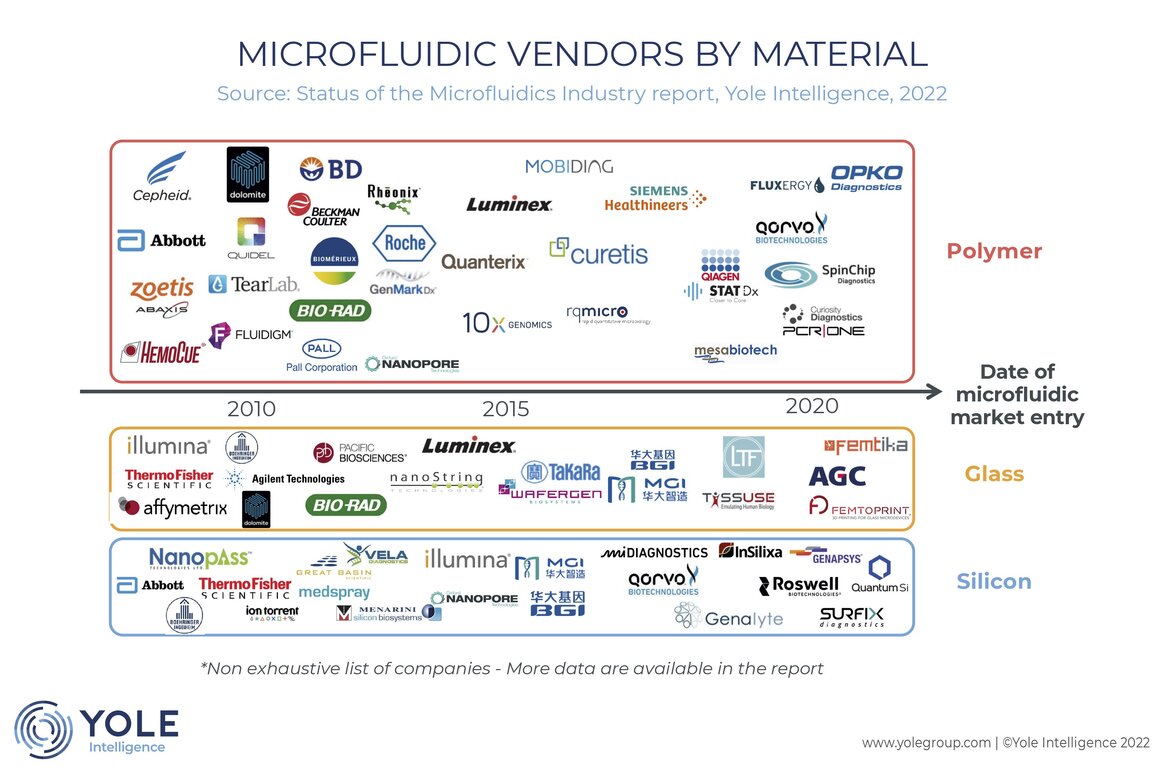

New products, including products in development, are integrating more and more functionalities, improving the portability, the ease-of-use, and the accuracy of the tests. These functionalities are now possible due to the integration of several functions inside the microfluidic modules. Various functions are performed by pumps and valves for fluid management, blisters, which contain reagents, electrodes for electrical measurements, microarrays to do multiplexing, or CMOS sensors used for the detection of biomolecules of interest. This involves the use of multi-material processes combining plastics, glass, and silicon.

All these functionalities require specific manufacturing processes. It would be challenging for start-ups or small companies to be competitive and profitable at small to mid-scale. However, many opportunities are emerging in the market. Experts in microfluidics have formed alliances to offer an all-inclusive service from the design and prototype to the scale-up of production. Two recent Dutch examples are Flow Alliance (Micronit, Helvoet, Axxicon) and Microfluidics Innovation Hub, which offer this kind of service. This enables easy access to complex manufacturing processes. Semiconductor fabs have also enhanced their production capabilities, such as IDEX, SCHOTT, and TE Connectivity, targeting big microfluidics players producing polymer, glass, silicon, or hybrid devices.

The microfluidic market is at a new stage of its evolution and is experiencing many challenges. Manufacturing processes are becoming increasingly complex due to the higher number of integrated functionalities in microfluidic modules. The increase in production volumes coupled with the complexification of the manufacturing chain requires ever more investment in manufacturing equipment. Informatic technologies are one of the trends observed to improve or add value to microfluidic devices. For example, a series of diagnostics can be followed over time thanks to cloud solutions improving and facilitating online medical consultations. At the software level, artificial intelligence is building up for complex data analyses on data generated during next-generation sequencing.

This illustrates that an affordable price is no longer the only factor of importance in the development of new microfluidic products. Small and big microfluidics players alike will have to gear their actions in the coming years on the future of the microfluidic market.

IVAM members receive a discount on the regular price of Yole's studies. Please contact Sandra Hinse at sh@ivam.de if you are interested.