Climate change is on everyone's lips - yet much remains to be done. The consequences of climate change are becoming increasingly visible in everyday life through extreme weather phenomena or rising food prices due to poor harvests. That is why the demand also on companies and institutes to operate sustainably or to contribute to improving the situation with technologies and/or products becomes more and more urgent.

In this year's economic data survey, the IVAM Microtechnology Network placed a focus on the topic of sustainability/ circular economy. In this context, the expectations of the microtechnoloy branch from the new German Federal Government were also queried, which with the participation of the party "Die Grünen" seems predestined for a policy turnaround with regard to the climate issue.

The survey was conducted before the start of the war in Ukraine - but does not lose its relevance because, on the one hand, the status quo of the organizations after the Corona pandemic is presented and, on the other hand, the special areas queried (sustainability/new German federal government) can also be considered independently of the current developments.

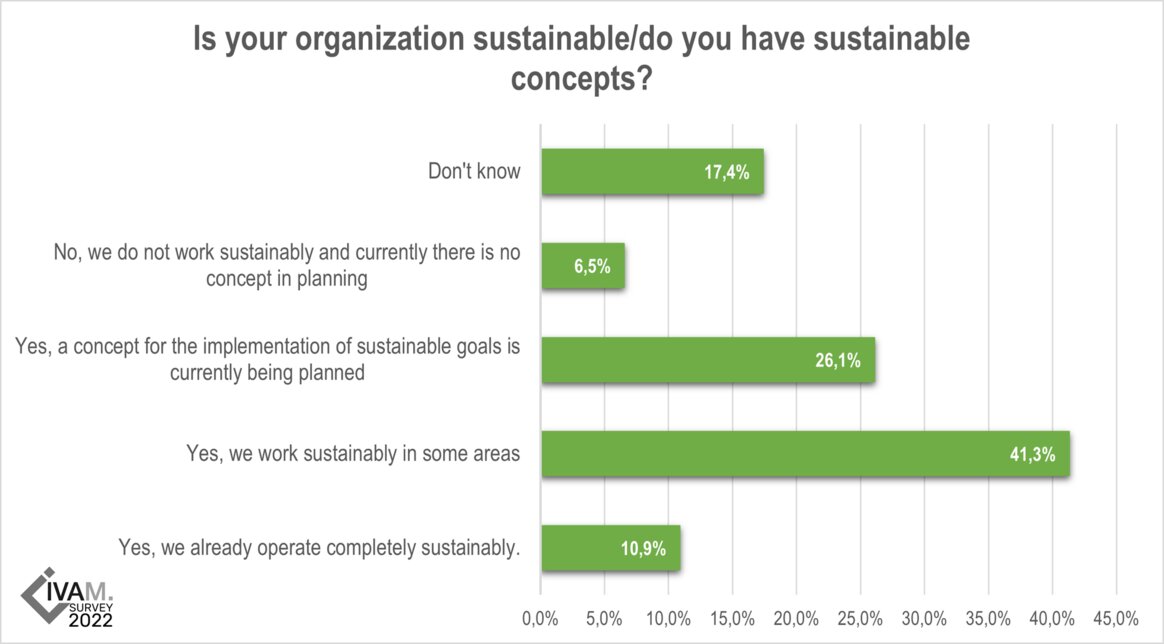

The topic of sustainability has arrived at the majority of respondents in the company - a total of 78.3% of respondents operate sustainably to a more or less extensive extent. Fully sustainable work 10.9% of respondents. In some areas 41.3% are sustainable and in 26.1% of the companies a sustainability concept is currently being developed. Only 6.5% of the respondents state that they do not operate sustainably and also have no concept in planning.

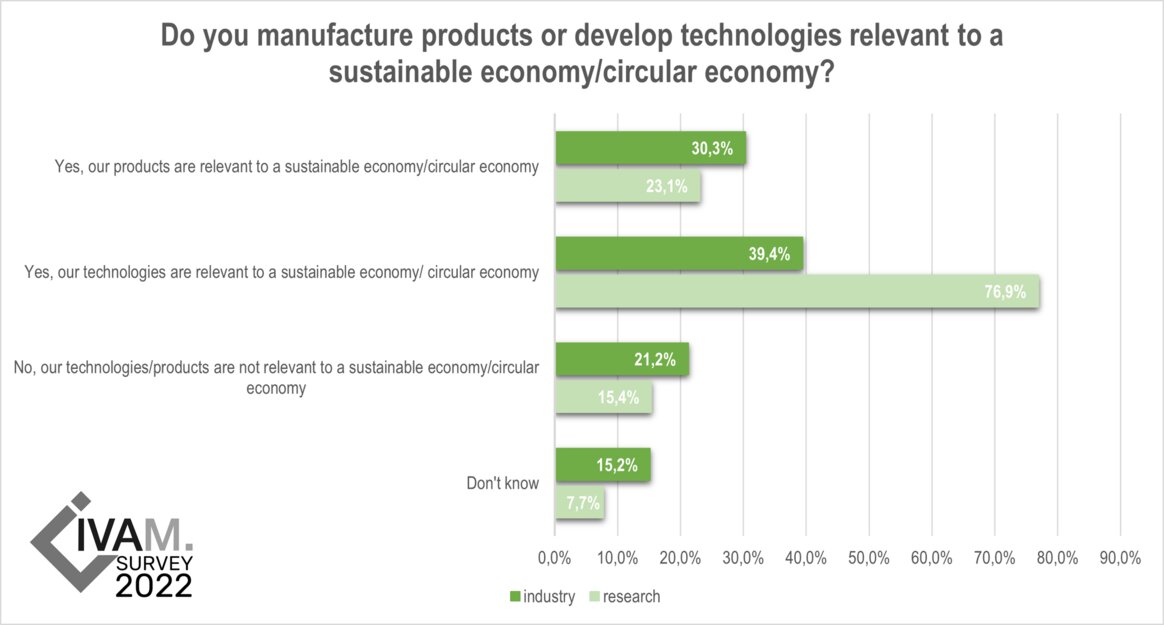

Another aspect of the topic is the concrete contribution made by organizations in the microtechnology sector to promoting sustainability in Germany and Europe. This takes the form of products and/or technologies that, for example, help to save resources, help to avoid climate-damaging waste products or produce reusable materials.

30% of the companies and 23.1% of the research institutes state that their products are relevant to a sustainable or circular economy. In terms of technologies, the relevance of the industry is even clearer - 76.9% of institutes and 39.4% of companies develop technologies that contribute to promoting sustainability.

Based on the contents of the coalition agreement, German organizations expect the new German government in particular to provide targeted support for key enabling technologies such as biotechnology, AI, quantum technology, and the semiconductor industry (80.0%), as well as a policy to secure skilled workers through, for example, appropriate training and continuing education measures in the area of microtechnology (73.3%). Half of the respondents would also like to see support for small and medium-sized enterprises, for example through easier access to the capital market or support for digitalization.

When asked what impetus they expected from the German government to strengthen Germany as a technology location, the organizations surveyed named a large number of measures, some of which coincide with the points mentioned above, but often go beyond them.

Among the measures mentioned were:

The points of strengthening key technologies, expanding the digital infrastructure and improving the funding landscape were mentioned several times - in varying wording - and correspond to the external and internal challenges that companies face today and in the future (see below) and for which they would like to see solutions

60.0% of the companies state that their sales in 2021 have increased compared to the previous year. At 20%, sales have remained stable. A similar development can be seen in the number of employees. At 50% of the companies surveyed, there was an increase in employee numbers in 2021. At 36.7%, the figure remained unchanged. Only exports grew to only a moderate extent. 23.3% of the companies stated that their exports had increased, while for 30.2% exports remained stable. This could be an indication that production is increasingly shifting to the domestic market.

In terms of forecasts, the mood at the time of the survey was also optimistic. The majority of respondents expect both sales and employee numbers to increase in the next three years (60.0% and 83.3% respectively). A renewed increase in exports is seen by 41.9% of the companies. Whether this development will actually occur after the outbreak of the war in Ukraine remains to be seen.

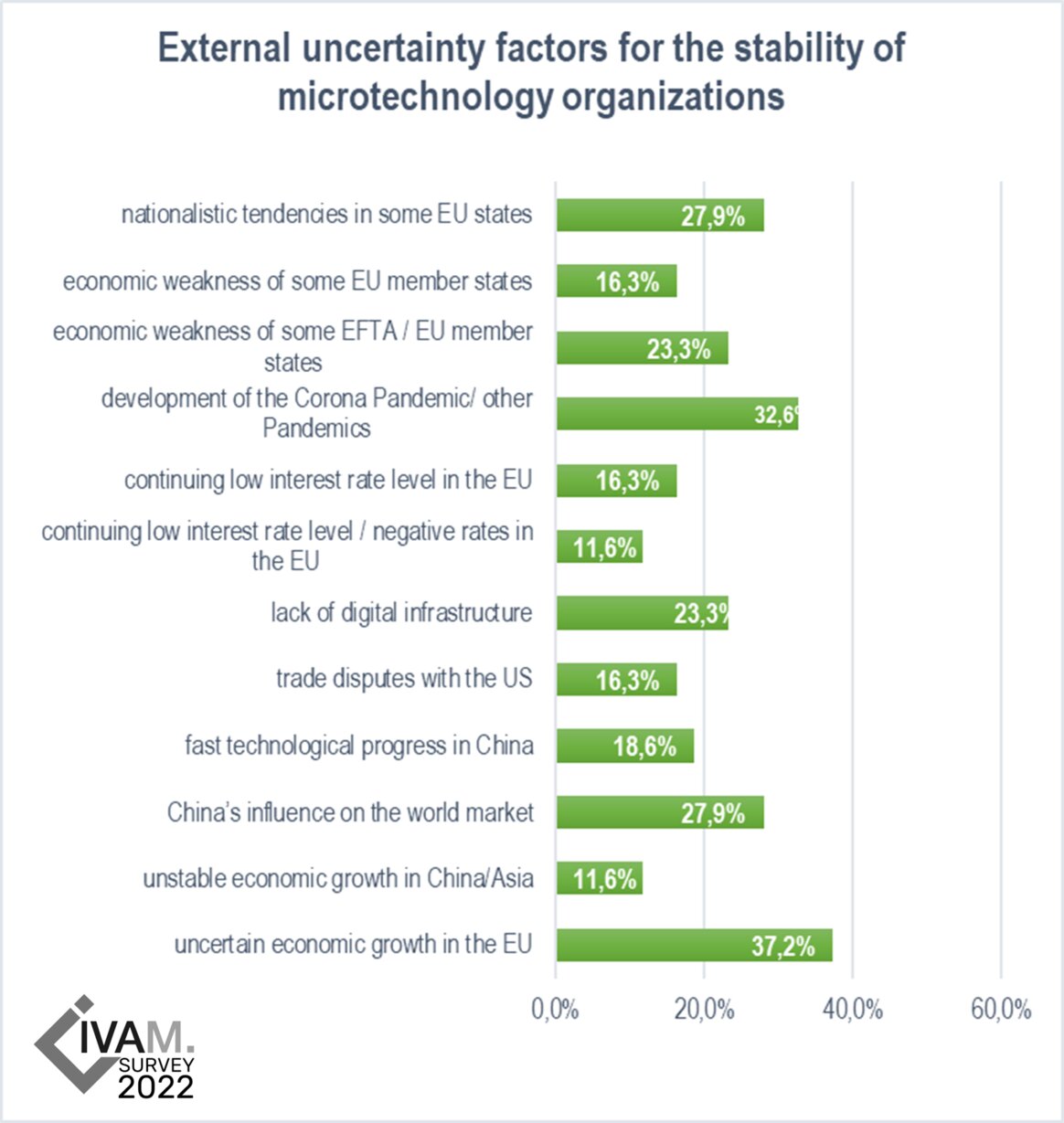

At the time of the survey, 65.1% of the organizations surveyed see developments in the EU in particular (this includes uncertain economic developments on the one hand, and increasingly obvious nationalist tendencies in individual EU states on the other) as the greatest external uncertainty factor that could jeopardize stability in the industry. Other uncertainty factors include the development of the Corona pandemic or other pandemics (32.6%), China's influence on the world market (27.9%), and the lack of digital infrastructure or the economic weakness of some EFTA/EU member states (23.3% each).

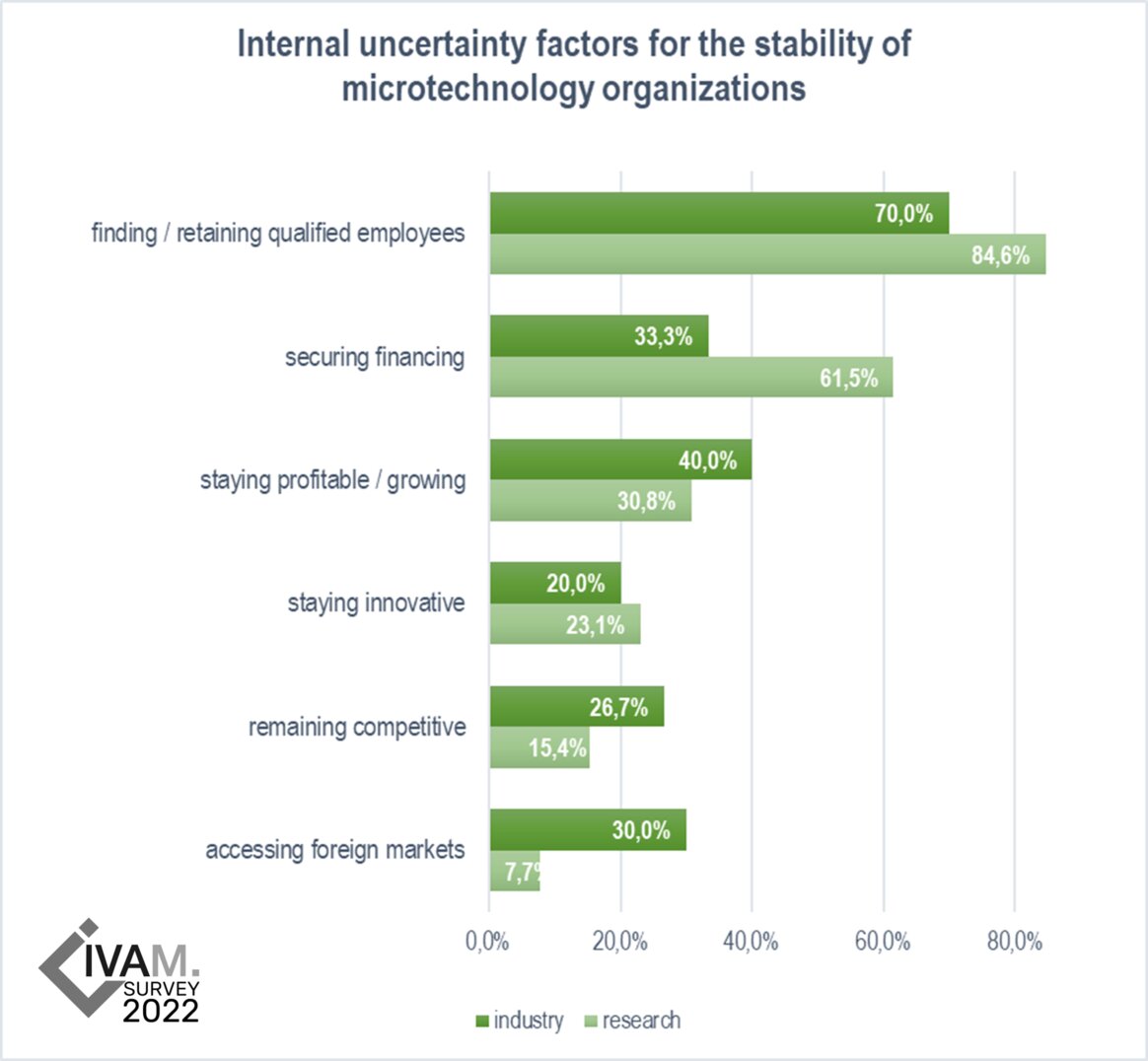

In the last survey in 2020, the organizations surveyed were already strongly confronted with the challenge of finding and retaining suitable skilled workers. The proportion of organizations that see this as an internal uncertainty factor has risen even further since then. For 70.0% of the companies and 84.6% of the research institutions surveyed, the issue of attracting and retaining skilled workers is the greatest uncertainty factor with regard to internal development opportunities.

In addition to the factor of attracting skilled workers, the companies surveyed consider staying profitable (40.0%), securing financing (33.3%), accessing foreign markets (30.0%) and the point of remaining competitive (26.7%) to be the greatest factors of uncertainty with regard to internal stability.

Profitability is always a pressing issue for the suppliers, some of whom are highly specialized and frequently supply customized solutions in small batch sizes. In view of the still uncertain development of the pandemic and the economic situation in the EU, these concerns are likely to intensify again if necessary.

Overall, it remains to be seen how the progress of the war in Ukraine and the possible resurgence of the pandemic at the end of the year will affect the organizations in the microtechnology sector.

The microtechnology industry has managed the Corona crisis quite well and is currently focusing intensively on sustainability. The industry is …

Through the event series "Spotlights", continuous insights into the latest state of research and development as well as topics and …

The Würzburg based IVAM-member company Multiphoton Optics GmbH will become a subsidiary of Heidelberg Instruments Mikrotechnik GmbH, after resources have …